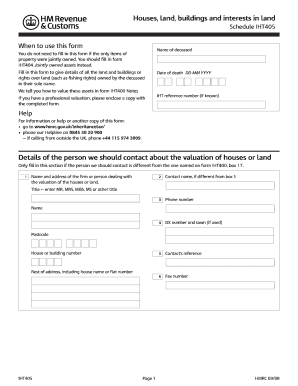

UK HMRC IHT405 2018-2024 free printable template

Get, Create, Make and Sign

How to edit iht405 online

UK HMRC IHT405 Form Versions

How to fill out iht405 2018-2024 form

How to fill out iht405:

Who needs iht405:

Video instructions and help with filling out and completing iht405

Instructions and Help about iht 405 form

This is just eight pages long and there are no schedules and this is a form I'll be going through in this talk there is an explanatory booklet which I will refer to HD 206, but even this document comes to 30 pages so although the HD 205 is much more straightforward than the ISDN 400 you still need to be careful before I go on to the actual form just a point about the calculation of inheritance tax this is not a lecture on tax this part of the webinar is just to explain very basically how you can't calculate whether the state is liable if it is you will need to do further research on how to calculate exactly how much you must pay the tax rebounds normally called the nil rate band or NRL is three hundred and twenty-five thousand pounds per individual this means that if the deceased estate is less than that's figure three non-twenty-five thousand pounds there's no text plain once the estate comes to over this figure then taxes child on at forty percent on the adult over the three hundred twenty-five thousand pounds that's straightforward enough if the deceased estate clearly comes within that figure then you should be okay with going ahead with the ITT 205 for example in my apartment world the average cost of property is a hundred fifty thousand pounds if it is urgent joint names that each co-owners share is seventy-five thousand pounds even with all their sins most people fall well within the no rake brand limit and there is no inheritance tax to pay there are also releasing exemptions which I can't go through in this webinar it isn't intended for that purpose, but there aren't two released I would like to mention or get it briefly firstly the transferable no rate band or T n RB there's an applies to married couples and Villa partners only not to marry couples unmarried couples no matter how long they've been together so how does it work well as mentioned each individual has a nil rate band of three hundred and twenty-five thousand pounds if a spouse dies having not used his know rate band then the estate of the second spouse to die can add that to her own NRL nor a band making a total of six hundred and fifty thousand pounds this figure can be eaten into even if this figure can be eaten into if this first bounce has made lifetime gifts during the seven years immediately before he died if this is likely then you must check his records as this can materially affect whether tax is payable or not the other important point is that even if you're entitled to claim transferable no red band it doesn't happen automatically you've got to claim it using the form ITT two one seven which I'll come to later in this webinar the other relief I've got to mention is the residence in the red band of our or our n RB this again is very complicated and if your estate comes within that three hundred twenty-five thousand pound mark as mentioned above then you may not need to worry about it, but you should have some idea about it the basic elements are I didn't again...

Fill inheritance tax form iht 405 : Try Risk Free

People Also Ask about iht405

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your iht405 2018-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.