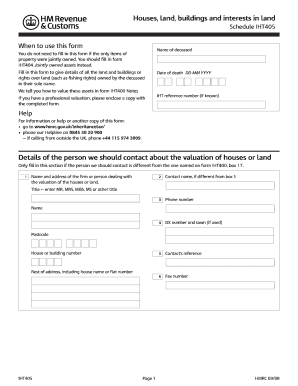

UK HMRC IHT405 2018-2025 free printable template

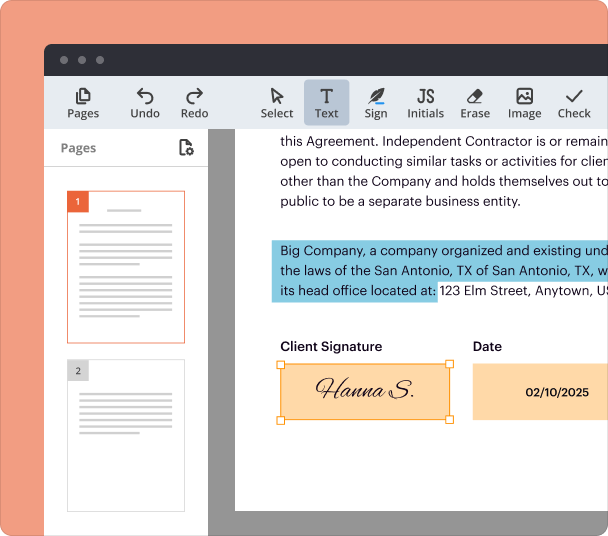

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

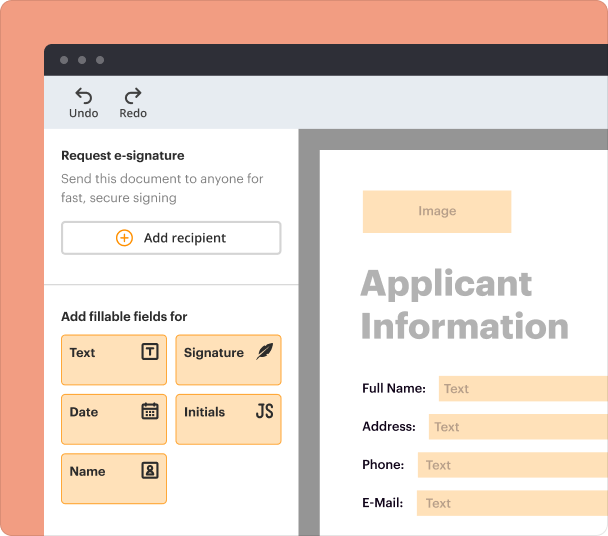

Create professional forms

Simplify data collection

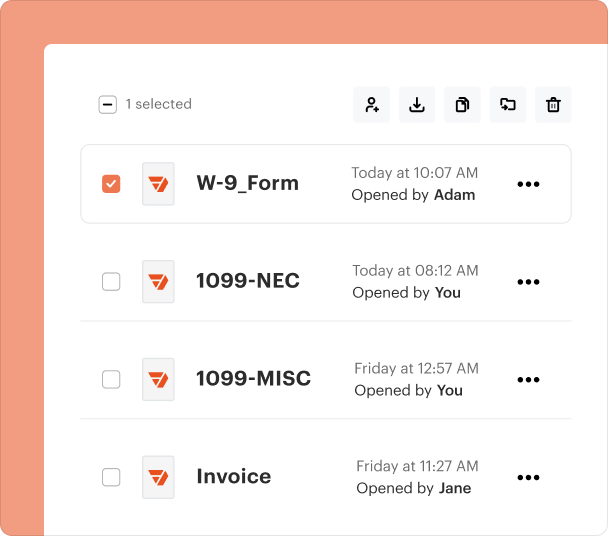

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Comprehensive Guide to Filling Out the UK HMRC IHT405 Form

What is the purpose of the IHT405 form?

The IHT405 form plays a crucial role in the Inheritance Tax (IHT) assessment process in the UK. It allows heirs and executors to provide details about the deceased's estate, which may include assets like land and property. Understanding the importance of this form is vital, as it ensures compliance with tax obligations and helps avoid penalties. Notably, the 2 version introduces several key updates aimed at streamlining the reporting process.

-

Accurate reporting of values is essential to avoid misrepresentation and potential legal issues.

-

Providing land and property information is vital for assessing the inheritance tax liability.

-

The 2 form contains updates that need to be understood for accurate submissions.

When should you use the IHT405 form?

Understanding when to complete the IHT405 form is critical for executors and family members managing an estate. It must be filled out in specific situations, such as when the deceased had certain assets or when the estate's value exceeds the tax threshold. Failing to submit the IHT405 form within the designated timeframe can result in penalties or interest on unpaid taxes.

-

If the total value of the deceased's estate surpasses the IHT threshold, filing is mandated.

-

In cases where the deceased owned various properties or investments, the form is necessary.

-

Submitting the form promptly is crucial to mitigate penalties related to inheritance tax.

How to complete the IHT405 form step by step?

Completing the IHT405 form involves multiple sections requiring detailed information about the deceased and their estate. Typically, the form comprises sections where you'll need to provide personal details, address information for properties, and asset valuations. Each section includes guiding questions to ensure that the provided information meets HMRC specifications.

-

Gather necessary personal identification and estate details.

-

Document the addresses and ownership statuses for all relevant properties.

-

Accurately assess the value of each asset and include relevant proof of valuation.

Using tools like pdfFiller can significantly enhance this process by providing templates and allowing users to fill out sections electronically.

What are the best practices for valuing properties?

Accurate property valuation is crucial for completing the IHT405 form. Valuators recommend following best practices to ensure that properties are assessed fairly and accurately. This may involve hiring professional valuators or using appraisal services that comply with HMRC guidelines.

-

Professional valuators can provide accurate assessments necessary for the form.

-

Researching current market prices can help provide context during property assessments.

-

Detailed descriptions prevent ambiguity and clarify ownership and asset condition.

What key information should be included for valuations?

When providing valuations for the IHT405 form, several types of information must be included. This includes mandatory specifications laid out by the form, such as contact details for valuators and any supporting documentation that verifies the valuation. Being thorough and precise will help avoid complications down the line.

-

Includes specific details clearly outlined in the IHT405 form guidelines.

-

Providing contact details ensures transparency and traceability for valuations.

-

For instance, submitting incomplete forms can lead to processing delays.

How can use pdfFiller for the IHT405 form?

pdfFiller stands out as a practical solution for completing the UK HMRC IHT405 form. Its interactive features and user-friendly interface make it easy for individuals and teams to manage document workflows. Features such as eSignatures, cloud storage, and collaboration tools empower users to edit and share their completed forms securely.

-

pdfFiller simplifies the IHT405 completion, saving time for users.

-

Utilize eSignatures and collaborative tools to enhance the filing process.

-

Securely save your completed forms and share them as needed.

Where can find additional support and resources?

When filling out the IHT405 form, having access to reliable resources can come in handy. Many official government websites provide guidance and support problems encountered during the filing process. Additionally, helplines and service centers are available for those in need of immediate assistance.

-

Government websites often feature guidelines and downloadable forms.

-

Reach out to support staff for complex queries regarding IHT submission.

-

Explore neighboring forms that might complement the IHT405 for comprehensive filing.

Frequently Asked Questions about iht405 form

Who needs to fill out the IHT405 form?

The IHT405 form must be completed by the executor or administrator of the estate if the deceased had property or an estate value exceeding the tax threshold. It's essential to reflect the total value accurately to comply with inheritance tax regulations.

What happens if the IHT405 form is submitted late?

Submitting the IHT405 form late can lead to penalties and interest charges on the unpaid inheritance tax. To avoid issues, it is important to adhere to the deadlines provided by HMRC.

Can I submit the IHT405 form electronically?

Yes, the UK HMRC allows submissions of the IHT405 form electronically through their online services. This can often expedite the process and reduce paperwork.

Are there any fees associated with submitting the IHT405 form?

Generally, submitting the IHT405 form does not involve fees; however, hiring valuators or legal assistance may incur additional costs. Always budget for associated estate management expenses.

How long does it take to process the IHT405 form?

The processing time for the IHT405 form can vary based on the complexity of the estate. Typically, it may take several weeks for HMRC to review and process the form.

pdfFiller scores top ratings on review platforms