UK HMRC IHT405 2018-2026 free printable template

Show details

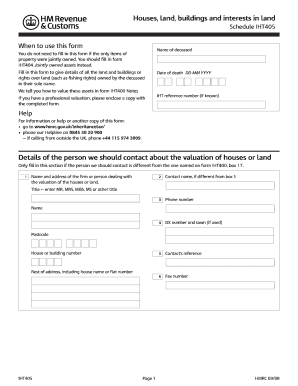

Houses, land, buildings and interests in land Schedule IHT405When to use this form Fill in this form to give details of all the land and buildings or rights over land (such as fishing rights) owned

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign iht405 form

Edit your iht forms online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your iht 405 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit iht405 form download online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit iht 405 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC IHT405 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out inheritance tax form

How to fill out UK HMRC IHT405

01

Gather all necessary information about the deceased person's financial assets, including property, bank accounts, investments, and personal possessions.

02

Complete the personal details section, including the name, address, and National Insurance number of the deceased.

03

Provide information about the deceased's estate, listing all assets and their approximate values.

04

Complete section regarding any debts or liabilities, including mortgages, loans, and outstanding bills.

05

Include details about any gifts made by the deceased in the last seven years before death.

06

Summarize the total value of the estate by calculating the net value after subtracting debts from assets.

07

Review the form for accuracy and ensure all details are clearly written.

08

Submit the completed IHT405 form to HMRC, along with any required supporting documentation.

Who needs UK HMRC IHT405?

01

Any executor or administrator of an estate where the deceased's estate exceeds the inheritance tax threshold.

02

Beneficiaries of an estate who need to understand the inheritance tax liabilities.

03

Legal representatives handling the estate of a deceased individual.

Fill

iht405 form pdf

: Try Risk Free

People Also Ask about iht 405 pdf

Do non residents pay UK inheritance tax?

If you're not a UK resident, you do not usually pay either: Capital Gains Tax if you sell most assets in the UK. Inheritance Tax if you inherit assets located in the UK.

Do I need to complete IHT400?

You must complete the form IHT400, as part of the probate or confirmation process if there's Inheritance Tax to pay, or the deceased's estate does not qualify as an 'excepted estate'. You can use the notes and forms IHT401 to IHT436 to support you.

What is a IHT406 form?

Schedules are additional forms used to set out different categories of information: for example, IHT406 is used to provide details of the bank and building society accounts of the person who has died. The IHT400 will indicate which additional schedules you will need to include.

How much can you inherit without paying tax UK?

Each individual has their own NRB which is £325,000 for 2023/24. Any part of the estate up to the NRB threshold is chargeable to IHT at a rate of 0%. Any part of the estate that exceeds the NRB threshold is usually chargeable to IHT on death at 40%.

How do I get around inheritance tax?

Set up a trust to avoid inheritance tax If you put assets into a trust, provided certain conditions are met, they no longer belong to you. This means that, when you die, their value normally won't be included when the value of your estate is calculated. Instead, the cash, investments or property belong to the trust.

What is the inheritance tax rate for non residents in the UK?

The standard rate for inheritance tax in the UK is 40%. Tax rates and exemptions are the same for nationals and foreign residents, as well as for non-residents with property in the UK.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit iht405 form hmrc from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your iht form 405 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I sign the iht405 hmrc electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your iht 405 uk in seconds.

How do I complete iht 405 download on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your iht405 pdf. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is UK HMRC IHT405?

UK HMRC IHT405 is a tax form used for reporting inheritance tax on the estate of a deceased person. It details the assets and liabilities of the estate to assess whether inheritance tax is payable.

Who is required to file UK HMRC IHT405?

The executor or administrator of the estate is required to file UK HMRC IHT405 if the deceased's estate exceeds the inheritance tax threshold and requires an assessment of inheritance tax liability.

How to fill out UK HMRC IHT405?

To fill out UK HMRC IHT405, gather all necessary information regarding the deceased's assets, liabilities, and their values. Follow the instructions on the form, providing accurate figures and necessary details about each asset and liability.

What is the purpose of UK HMRC IHT405?

The purpose of UK HMRC IHT405 is to provide HMRC with detailed information about a deceased person's estate to determine the inheritance tax due, ensuring compliance with tax regulations.

What information must be reported on UK HMRC IHT405?

UK HMRC IHT405 requires reporting information such as the value of the deceased's assets (property, bank accounts, investments), liabilities (debts and funeral expenses), and any exemptions or reliefs that apply to the estate.

Fill out your UK HMRC IHT405 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hmrc iht405 is not the form you're looking for?Search for another form here.

Keywords relevant to form hmrc houses

Related to hmrc houses land

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.